Payroll & Paycheck Essentials

We are a service-oriented department committed to assisting employees and administrative departments.

- It’s not a check, it’s a WARRANT. The State Controller’s Office (SCO), which issues your pay, refers to paychecks as PAY WARRANTS.

- It comes from the State. The SCO mails pay warrants to the campus. The warrants are distributed by University Cash Services to a designated member of your department.

- Your Pay Warrant is issued monthly.

-

- Warrants for salaried faculty and staff members are usually issued on the last day of the month or the first day of the next month.

- Hourly employees, student workers, shift differentials, bonuses, stipends, excess plus, and special payments are paid on the 15th of each month. If the 15th of the month falls on a Saturday, Sunday or University holiday, payday will be the prior business day.

- If you are enrolled in Direct Deposit, your Direct Deposit Advice/Paystub can be viewed and downloaded on Cal Employee Connect (CEC)

- For a detailed Pay Warrant Legend explaining your pay warrant, please use: Pay Warrant Legend

- Note: Requests for duplicate pay stubs cannot be processed through Payroll. Please be sure to maintain any records you need.

- Additional Federal Tax Withhold for Nonresident Alien

Mandatory Payroll Deductions:

- Federal and State tax

- Medicare tax (1.45%), if applicable

- Social Security (6.2%), if applicable, to annual maximum earnings of $176,100.00 (2025)

- Retirement (percentage based on your contract), if applicable

- Flex-Admin fee, if applicable

- When an employee pays any portion of their health premium, the State Controller’s Office (SCO) charges an administrative fee of $0.17 to forward your payment to the insurance carrier.

- "Fair Share" or membership dues for union affiliation, if applicable; for more information, visit California State University Labor Relations Page

Voluntary Payroll Deductions:

- Insurance

- Membership dues

- University Affiliated Charitable Contributions

- Parking *

To make changes on your current tax withholding status for federal and state taxes by using 1. Cal Employee Connect (CEC) OR 2. Employee Action Request Form

- Cal Employee Connect (CEC) Employee Services feature has expanded to include a Withholdings Change feature. The Withholdings Change feature has been created as an additional self-serve option. If you already have current Withholdings on file, you do not need to submit a new request through CEC.

CEC Withholding Change Instruction

2. Make changes to your tax withholding status for federal and state taxes by

- Staff and Faculty - completing the Employee Action Request Form (Instruction for Employee Active Request Form)

- Student Employee - completing a Student Action Request form

(Forms should be submitted at least 15 business days prior to your next payday for the change to take effect during the current reporting period)

You can use the following links to calculate the amount of taxes and other deductions taken from your Pay Warrant.

- Instructions on "How to Use Paycheck Calculator"

- Paycheck Calculator

- or CEC Paycheck Calculator

Pay Warrants are valid for one year from the date of issue.

Email a completed Duplicate Controller’s Warrant / Stop Payment STD 435 forms to disbstd435@sco.ca.gov

To request the status of a previously submitted STD 435 and it has been more than 4 weeks, contact disbgeneral@sco.ca.gov for assistance.

If you have a pay warrant that is over one year old, contact Payroll Administration regarding reissuing the warrant. If your pay warrant is more than three years old, you must request a replacement warrant directly from:

State Board of Control Government Claims,

PO Box 3035, Sacramento, CA 95812-3035

(800) 955-0045

- If you have had the pay warrant in your possession and it becomes lost, stolen or destroyed, come to the Office of Human Resources for assistance in completing an affidavit requesting a duplicate warrant.

- This form will then be submitted to the State Controller’s Office. Please keep in mind that it takes approximately 6- 8 weeks for a duplicate warrant to be issued.

1. Eligibility:

All active employees are eligible to sign up for Direct Deposit.

2. How to Enroll:

All new direct deposits and direct deposits changes will be done via Cal Employee Connect (CEC) (https://connect.sco.ca.gov). CEC is a secure website developed by the State Controller of California for all state employees to review payment stubs and obtain W-2 information. New employees will receive their first payment as a live pay warrant. Information obtained from that warrant will be used to create an account with CEC.

Please note the new Direct Deposit feature is an additional option for staff to submit a New/Change Direct Deposit request and will not affect employees already on direct deposit. One new enrollment or change request will be allowed every 30 days. For change requests do not close your original account until you can determine that your new direct deposit has taken effect.

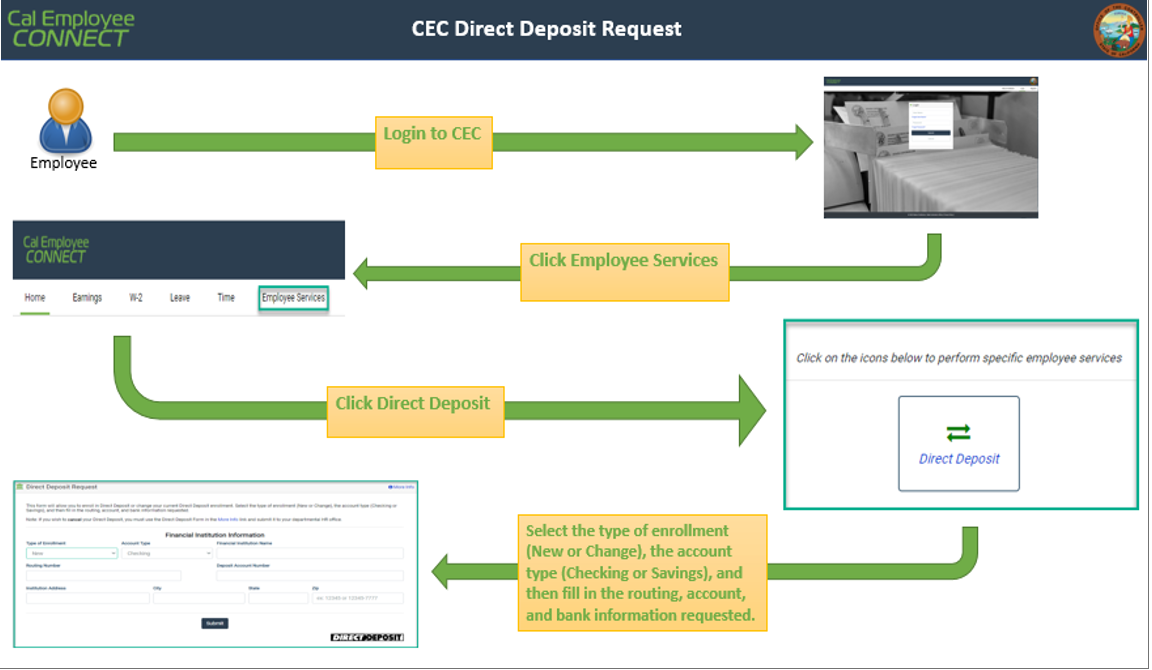

To use the direct deposit service via CEC please follow the following steps”

ENABLE CEC MFA:

Select User Profile, Click Turn On MFA, and follow instructions within the application to download authenticator App to your phone and enjoy an extra layer of security to your CEC account.

- Multifactor Authentication (MFA) User Guide

- As a preventive measure, we recommend that users log into CEC and deactivate their MFA from their User Profile before changing phones. Once they have their new phone, they can reinstall and set up MFA again. We also recommend using a personal MFA app rather than an employer-provided one. Otherwise, they will need to contact us to reset their MFA.

Enroll or Change Direct Deposit:

3. How the Cancel:

Contact your HR Payroll Representative immediately if your bank account had been hacked, canceled, or compromised.

4. More direct deposit information:

General Information:

- Annual W-2 Statements are mailed each January directly from the State Controller's Office to an employee’s address on record with Payroll Administration as of December 9. To update your personal information, use the SF State Gateway

- The November period is considered to be the last pay period of the tax year and the December pay period (warrant issued on January 1) is the first pay period of the new tax year.

- W-2's returned by the post office are kept on file in Payroll Administration. You may contact the office after February 16, to inquire if your W-2 was returned to the campus.

Requesting a Duplicate W-2 form:

If you do not receive a W-2 Form, or if you need a duplicate W-2:

-

If you have not received your W-2 by January 31, please verify your address on file with Human Resources on SF State Gateway

-

Duplicate copies of W-2's can be requested from the State Controller's Office. Information is online: California State Controllers Office Request a Duplicate Form W-2

Form W-2 Wage and Tax Statement FAQs

Paperless W-2 & More W-2 Information

Legal Name Change and Other Personal Information Updates

Names and other personal information are housed in multiple systems on campus. Please review the information below to determine where you would like to make updates.

Legal Name for Employees

Payroll manages any legal name changes that state employees wish to make. Employees must have a new Social Security card that includes the name change. The new legal name must be an exact match with the name on the social security card.

To request a change to your legal name, follow these steps:

Faculty and Staff

- Complete an Employee Action Request Form-Name Change on https://docusign.sfsu.edu/

- Attach a copy of your new Social Security Card

Student Employee

- Complete a Student Payroll Action Request Form Name Change Request on https://docusign.sfsu.edu/

- Attach a copy of your new Social Security Card

You will receive email confirmation that your update has been signed and your request will be processed to Payroll.

Upon receipt your legal name will be updated within 3-5 business days. Legal Name changes will not be processed unless a copy of the Social Security card is received.

This affects how your name is displayed in:

- State Controller's Office, pay warrant and W-2

- PeopleSoft-HR administrative and Self-Service pages and reports

Preferred/Chosen Name Change & Updating Personal Information

Preferred names will appear on the university directory, class, and grade rosters, and the iLearn system.

Instructions for updating your Preferred/Chosen name on Gateway

- Navigate and log in to SF State Gateway

- Click on Employee services

- Click on the Launch HR Self Service button

- Navigate to My personal information and select Names

- Click the Add a new name button

- Select Preferred from the drop-down menu and fill in how you would like your name to appear

- Click the Save button

To update additional personal information:

- Home/Mailing Address

- Phone Number(s)

- Emergency Contact(s)

- Email Address

Follow steps 1–3 above, then navigate to the relevant sections under My Personal Information to make and save your changes.

Based on your Collective Bargaining Agreement and/or position, you may be eligible to earn vacation, sick leave, and state service Accruals after a qualifying pay period. Most new, full-time employees accrue 6 2/3 hours of vacation, 8 hours of sick leave, and one month of State Service for each qualifying pay period.

Accruals are posted on or around the 8th of the following month. You can view your balances by logging into the portal.

1. Access the portal by signing in at SF State Gateway

2. Find the Employee Services > HR Self Service > Launch HR Self Service >

3. Choose menu item My Benefits

4. Choose Leave Balance

5. For monthly activity, click on the Details icon in the last column.

- SELF REPORTERS: Employees who report his/her own time and attendance in the system. Ask your manager if you are a self reporter.

2. NON-SELF-REPORTERS: Report time and attendance to their manager and/or department timekeepers.

3. Your department will provide training and procedures, as applicable. Contact your department to obtain additional information.

Dock Time Reporting Instructions for Employees

If you take time off that has been preapproved but do not have sufficient leave credits to cover the absence, or if you are absent without prior approval, the time may be recorded as dock. Please follow the steps below to ensure proper reporting and timely processing.

1. Review Your Leave Balances

- Log into Gateway

- Navigate to HR Self-Service >My Benefits> Leave Balance

- If you don’t have enough credits, time off may be subject to dock

2. Inform Your Supervisor

- Notify your supervisor in advance and request approval for the time off

- Confirm the specific dates and total hours that will be unpaid due to insufficient leave credits

3. Enter Dock Time in Absence Management

- Go to HR Self-Service > My Time > Report and View Absence

- Select “Dock” as the absence type

- In the comment section, briefly explain the reason (e.g., Unpaid Sick)

- Submit with accurate dates and hours

4. Submit Dock Form

- Submit a Dock Form to Payroll via DocuSign, approved by the 17th of the month

- Reporting late docks can result in an overpayment as an accounts receivable

5. Understand the Impact

- Docked time results in a reduction to your paycheck

Questions? Contact Payroll Services at payroll@sfsu.edu or your Department Payroll Analyst.