April 8, 2025

Dear Colleagues:

CSU Board of Trustee policy provides that the Chancellor conducts a review of each president at the outset of the third academic year of the president's tenure, and every three years thereafter. It is now time for the second triennial review of Dr. Lynn Mahoney, President of San Francisco State University, and you are encouraged to participate in the review.

Please find the Open Letter to the San Francisco State University Community about your opportunity to provide feedback as part of this process.

The criteria are posted on the CSU website (see link).

Please submit letters or emails no later than May 9, 2025, addressed as follows:

Dr. Mildred García, Chancellor

The California State University

401 Golden Shore

Long Beach, California 90802-4210

Email: presidentreview@calstate.edu

Thank you for your participation in this important, constructive process benefitting SF State students and employees.

The State Controller’s Office (SCO) will mail 2025 Form W-2 Wage and Tax Statements no later than January 31, 2026. Employees who have registered for Cal Employee Connect (CEC) and selected paperless delivery will receive their W-2 electronically through the CEC portal.

To ensure timely and secure delivery, employees are encouraged to verify their mailing address or opt in for electronic W-2 delivery through CEC by November 30, 2025. Address changes can be updated directly via HR Self Services by 12/13/2026.

For detailed instructions on how to register for Cal Employee Connect and access W-2 forms, please visit hr.sfsu.edu/w-2-information.

Thank you for helping us ensure a smooth and secure W-2 distribution process. Questions may be directed to Payroll Services at payroll@sfsu.edu.

Holiday Informal Time Off and Holiday Campus Closure Dates – December 2025

December 2025 Live Warrant Pick-up

Monday, December 08, 2025

Holiday Informal Time Off: December 24, 2025

San Francisco State received notice, consistent with the Governor’s policy, that CSU employees will receive a half day of informal time off with pay on December 24, 2025. In addition, President Mahoney has decided to close the SFSU campus and to provide SFSU employees with an additional half day of informal time off with pay on December 24, 2025. Accordingly, SFSU employees (exempt and non-exempt) will receive their regular pay for December 24, 2025, and do not need to use any accrued leave. Part-time employees will be provided with paid informal time off, pro-rated according to their time base.

Employees required to work on December 24, 2025, or who would be scheduled to work but are on vacation, sick leave, or CTO, may be granted the equivalent informal time off prior to June 30, 2026. This time may not be considered CTO and is not compensable in cash.

Please note, employees on alternate or compressed work schedules whose non-workday (i.e., regularly scheduled day off) falls on the date the campus will observe the Governor’s informal time off and additional time off authorized by the campus president, shall be granted the equivalent informal time off to be used prior to June 30, 2026. This informal time off shall not be considered as CTO and is not compensable in cash.

Hourly Employees

Hourly employees other than those in Class Codes 1150, 1151, 1152, 1153, 1360, 1860, 1861, 1868, 1872, 1874, 1875, 1876, 2680, 2681, 4662, 7171, 7172 and 7930 should be permitted informal time off based on the following table provided that the employee is scheduled to work on the campus' last work day prior to the holiday closure and is still on active payroll status on that date (has not or will not be separated with a prior effective date):

|

Hours Scheduled in December Pay Period |

Hours Off |

|---|---|

| 1-43 | 1 |

| 44-87 | 2 |

| 88 or more | 4 |

Scheduling of informal time off should be managed in such a way as to minimize disruption to campus operations.

Campus Closure Dates: December 24, 2025 – January 1, 2026

SFSU will be closed from December 24, 2025, through January 1, 2026, and will reopen on Friday, January 2, 2026.

-

Holiday Informal Time Off: December 24, 2025

- Observed Holidays: December 25, 26, 29, and 30, 2025, and January 1, 2026

- Campus Closure (Non-Holiday): December 31, 2025.

Accounting for December 31, 2025, Closure

Employees may choose to use the following options for accounting for the December 31, 2025 closure:

- Accrued vacation time

- Accrued comp time (CTO)

- 2025 personal holiday

- A dock in pay

For employees who have insufficient leave balances on 12/31/2025, the following options may apply:

- Non-Exempt Employees - If a non-exempt employee does not have sufficient leave credits (vacation, personal holiday or CTO) to cover the closure, and upon request from the employee, managers should provide sufficient work prior to the scheduled closure to prevent any loss of pay or benefits.

- Employees may also elect to be docked on the Campus Closure day. The Dock Notice (form also available on DocuSign) must be submitted to the Payroll@sfsu.edu by December 18, as noted on the 2025 SF State Staff and Faculty Payroll Calendar.

- Exempt Employees - Exempt employees who do not have sufficient leave credits are to contact their supervisor to receive an approved work assignment on the Campus closure day.

How to Report Absences - Non-Exempt and Exempt Employees must enter vacation, personal holiday, and/or CTO in PeopleSoft for December 31, 2025.

Employees who have not used their personal holiday for calendar year 2025 should use that option during the December 2025 pay period (no later than December 31, 2025) since the personal holiday cannot be carried over to the next calendar year. The personal holiday must be used in whole-day increments and a full-time equivalency may be eight (8) hours, or the number of hours in the employee’s regularly scheduled workday, as appropriate.

In accordance with collective bargaining agreements and CSU practice, vacation accumulation in excess of the maximum hours allowed will be forfeited as of January 1. (When computing the maximum allowable vacation limits, include December vacation accrual that is available the following January 1). Employees can view their leave balances via the Employee Self-Service function through the SF Gateway/MySFSU. Once signed into Self Service, click under My Benefits, then under the Leave Balance link. More accrued leave information, could be found at https://hr.sfsu.edu/accrued-leave-information .

December 2025 Live Paychecks:

By December 23, an email will be sent to employees who will receive a live paycheck (live paycheck warrant list will be available on Dec 31st for the December 2025 Pay Period) on how the obtain the paycheck on Payday, December 31, 2025.

For questions and clarification, please contact Agnes Cheng, Associate Director, Payroll acheng@sfsu.edu / 415-405-4359.

We wish you a safe and happy holiday season!

Payroll Services

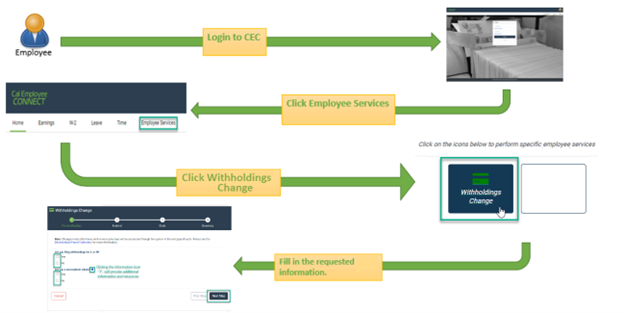

We are happy to announce that Cal Employee Connect (CEC) Employee Services feature has expanded to include a Withholdings Change feature. The Withholdings Change feature has been created as an additional self-serve option. If you already have current Withholdings on file, you do not need to submit a new request through CEC.

If you have not registered for CEC, additional information on how to join can be found on the HR/Payroll Cal Employee Connect webpage.

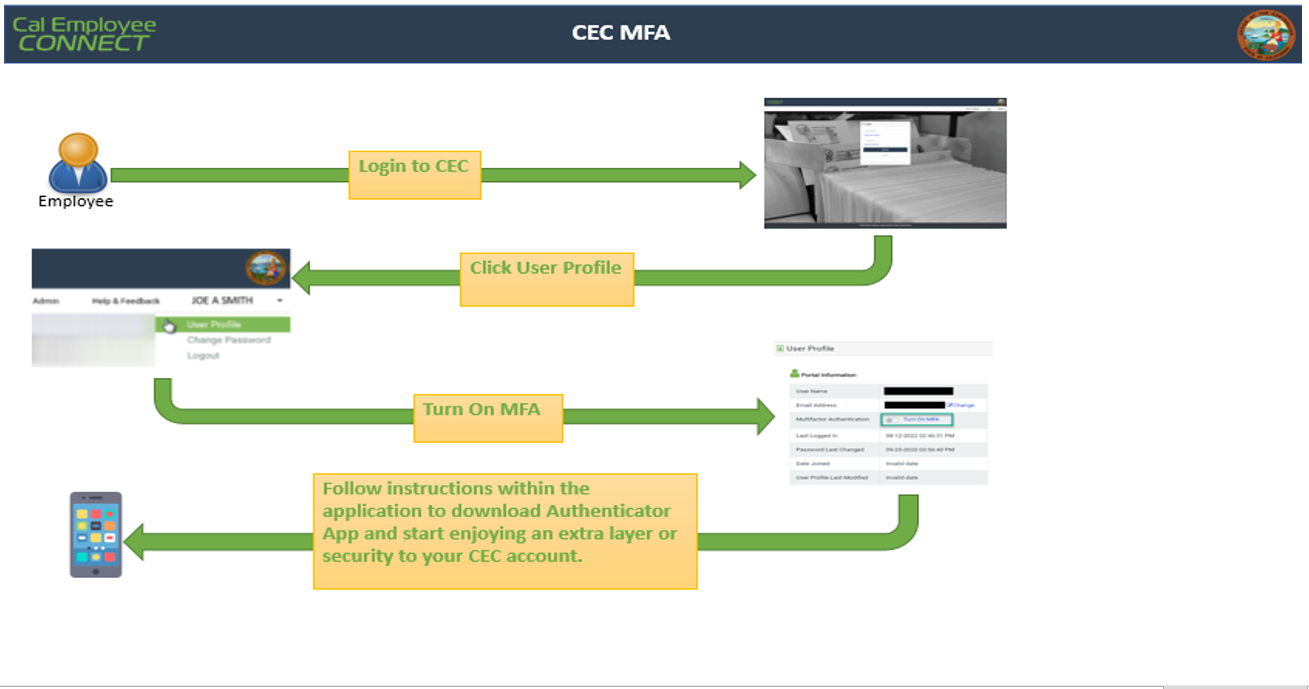

The first step to start using this feature is to enable Multifactor Authentication (MFA).

If MFA is not already enabled, select User Profile, Click Turn-On MFA, and follow instructions within the application to download an authenticator App to your phone and enjoy an extra layer of security to your CEC account.

The next step is to submit your Withholdings Change:

Select Employee Services from the top navigation bar and follow instructions within the application.

Note:

- CEC processes Withholdings change requests by close of business Monday through Friday; please allow 24 hours for submitted changes to reflect in your CEC account. If the change is submitted Friday evening through Sunday, the changes will be processed the following Monday and changes may reflect in your CEC account as early as Tuesday morning.

- The CEC Team is a technical team and unable to advise on withholdings change. If you have any questions regarding your Withholdings change, please refer to the IRS website.

Link: Cal Employee Connect (CEC) Withholdings Instructions

For technical questions or technical assistance with the Withholdings Change feature, please contact the CEC team at Help & Feedback.

Need Help?

Yes. In light of the increased number of employees working remotely to mitigate the spread of COVID-19 and as many of you are changing your commute to campus, we would like to let you know that you can adjust your commuter check deduction or temporarily opt-out of specific months through the Commuter Check website (https://login.commuterbenefits.com/). This will ensure you do not accumulate excess funds on your Clipper Card or Commuter Check MasterCard.

Find below an announcement on retired annuitant employment:

CalPERS retirees (from CSU and other California state/public agencies) are required by law to wait 180 days from their retirement date before working as a retired annuitant for any CalPERS agency, including the CSU / San Francisco State University. Note: the 180-day wait period does not apply to eligible faculty who retire and elect FERP (Faculty Early Retirement Program) participation.

- Employment duration of a retired annuitant is restricted to working 960 hours in a fiscal year.

- Hiring a retiree prior to their meeting the required 180-day waiting period, or employing them in excess of the 960 hours limit per fiscal year, jeopardizes their retirement benefits and/or requires reinstatement from retirement and is strictly prohibited.

This provision is in compliance with the requirements prescribed by the Public Employees’ Retirement Law and the Public Employees’ Pension Reform Act of 2013.

For further information and provisions reference CalPERS post-retirement employment

Or contact:

SFSU Benefits Helpline (415) 405.4004

Benefits & Retirement Services: benefits@sfsu.edu

Earlier this year, new legal requirements were implemented by the state for discrimination and sexual harassment prevention training. In accordance with the updated requirements, the Chancellor’s Office (CO) worked with risk management services provider United Educators to implement revisions to the Supervisor and Non-Supervisor Sexual Harassment Prevention courses, which all 23 CSU campuses are expected to administer to their respective employees. Effective, Jan. 6, 2020, the courses will be initiated for employees to take on CSU Learn. The following employees will be affected:

- Discrimination & Sexual Harassment Prevention for Supervisors: ALL administrators (Management Personnel Plan employees, senior and executive management)

- Discrimination & Sexual Harassment Prevention for Non-Supervisors: ALL non-administrator positions

Please note: These courses are mandated as a separate requirement from the CSU Campus Misconduct Prevention Program, the Title IX requirement overseen by Student Affairs & Enrollment Management. The new regulations can be reviewed online.

- Bystander: SB 1300

- Employer Sexual Harassment Training Requirements: SB 1343 and SB 778

- Hair Texture and Protective Hair Styles: SB 188

For more information please see our FAQ’s page

We are excited to introduce the use of Electronic Signatures Digital Forms through DocuSign. With DocuSign, departments can now initiate and submit all recruitment paperwork electronically.

At Human Resouces we are will continue working adding available electronic signature forms, to date, these forms are available to use:

- Recruitment Request Form

- Recommendation to Hire

- External Advertisement Approval Form

- Dock Notice

- Work Schedule

- Employment Verification Request

- Leave of Absence Request Form

To access the above forms and/or business process guides, please navigate to our Human Resources Forms page and select the DocuSign icon or the business process guide link.

For first time users, please click SF State Docusign and:

- Create a DocuSign account

- Create a digital signature

- Navigate to New > Use Template > Shared Folders > Human Resources, available Human Resources forms will be display

Help make SF State a greener campus and be part of the over 3,600 pages of paper saved since January.

If you have retired or planning to retire from San Francisco State, you have the opportunity to join your friends, and keep in contact with all the activities going on at the University.

The SFSU Retirement Association (SFSURA ) is a group of over 300 staff, faculty, and administrators who keep in touch with their work-related friends and the University by:

- Joining other campus-related groups for lectures, demonstrations and travel opportunities

- Enjoying two-holiday lunches each year, at Thanksgiving and during Spring Break

- Going on field trips to exciting destinations in the Bay Area, such as Coit Tower, museums, art galleries, parks, and other attractions

- Sponsoring travel grants to newer faculty and staff to enable them to attend conferences and conduct research

- Sharing a bi-monthly newsletter to keep us current on member activities.

- Your first year is free from dues!

JOIN US, it’s very easy to do: SFSU Retirement Association

Just print and fill out the membership application and return it to our Membership Chair, Irene Donner, at 814 No. Delaware St., #403, San Mateo, CA 94401.

What's New Quick Links