Dental Benefits

Employees are now able to submit their medical and dental enrollments forms using the secure DocuSign process. You will be required to log into DocuSign with your SF State credentials to complete the forms. Most forms will require you to begin by entering your SF State ID. You will also be required to read and accept the submission guidelines for the forms. Please review the DocuSign instructions for additional information . Document upload to MoveIt is no longer required when using DocuSign.

Additional documents will be updated to the new DocuSign process. Documents that do not require submission to the SF State Benefits Office will continue to be available in PDF format for your convenience.

As an employee of the California State University (CSU), you have a comprehensive program of health benefits including medical, dental, vision, flexible benefits programs and more available to you and, in many instances, your family.

Employees that are benefits eligible may enroll in one of several medical plans for themselves and their eligible dependents.

Plan and Benefits Information

Watch a video to learn more about your plan

Below please find information to help you understand and navigate the rules, guidelines and deadlines governing the CSU Benefits Program.

Eligible Employees

To be eligible for dental coverage:

- An employee must be appointed at least half-time (equivalent to 7.5 Weighted Teaching Units for academic year appointments) for more than six months, or;

- If employed in an R03 Lecturer or Coach Academic Year position, employee must be appointed for at least six (6) weighted teaching units for at least one semester, or two or more consecutive quarter terms.

- Qualifying appointments may be either permanent or temporary.

Once an employee has acquired eligibility and has enrolled in a plan, he/she may continue enrollment during subsequent continuous appointments of at least half-time regardless of the duration of the new appointment.

Non-Eligible Employees

Employees excluded from dental benefits include:

- Intermittent employees

- Student assistants

- Graduate assistants

- Faculty employed solely to teach summer session, extension, or intersession

- Any employee paid from funds not controlled by the California State University or from revolving or similar funds from which a regular California State University premium payment cannot be made.

Eligible Dependents

Eligible dependents of an eligible employee include:

- Spouse (unless legally separated or divorced)

- Domestic partner (registered through the Secretary of State process), and

- Dependent children from birth to the end of the month in which the child reaches 26. A dependent child includes a stepchild, a natural born child, or a child living with the employee in a parent-child relationship who is economically dependent upon the employee.

Dependents become eligible coincident with the Eligible Employee or upon attainment of dependent status. Newborn infants are eligible for medical coverage from and after the moment of birth. Adopted children are eligible for medical coverage from and after the moment the child is placed in the physical custody of the Eligible Employee for adoption.

Domestic Partners

State law allows, under specific conditions, for persons in the State of California to register non-marital relationships with the Secretary of State. This law also will recognize same-sex and opposite sex legal unions, other than marriage, validly formed in another jurisdiction that is substantially equivalent to a registered domestic partnership in California. Consequently, CalPERS will require information specific to the domestic partnership to determine whether or not a particular state/jurisdiction law will be recognized. Having obtained registration of the relationship, the law allows the registered individuals to obtain health benefits under the standard eligibility rules of the Public Employees' Medical and Hospital Care Act (PEMHCA). The California State University (CSU) elected to adopt the provisions of this law offering health care coverage (medical, dental and vision) for domestic partners of CSU employees and annuitants subject to the Secretary of State approval process and the CalPERS' acceptance process. Effective 1/1/2020 Assembly Bill (AB) 30 removed the age 62 requirement for opposite-sex domestic partners. For more information, please visit TL-BEN2020-09.

Current Domestic Partner Tax Dependent Certification Form

**The IRS has ruled that the actual cost of the domestic partner benefit is taxable income to the employee. Federal income, social security and Medicare taxes are deducted monthly from the employee’s paycheck upon addition of a domestic partner to the health and/or dental plans.

***Employees who enroll dependents age 24 - 25 may incur additional state income tax liability.

Required Documents

If you plan to enroll any dependents (spouse and/or children), please have the following documents and information available at the Orientation:

- Marriage Certificate (spouse) or

- Declaration of Domestic Partnership (Domestic Partner)

- Birth Certificate (dependent child under 26) or

- Adoption Certificate (adopted child under 26)

- Affidavit of Eligibility for Economically Dependent Children (economic dependent under 26)

- Social Security numbers are required for all dependents

*** All documents must be in English. If they are not, they must be translated and notarized prior to submission.***

Plan and Benefits Information

- Employees can enroll in Delta Dental PPO for themselves and their eligible dependents.

- Both plans are administered by Delta Dental of California.

- The premiums for these dental plans are paid by the CSU.

- When you have made your choice, fill out a Dental Enrollment Form, return the completed form to Benefits and Retirement Services. Please remember to include all supporting documentation when submitting to Human Resources.

- When you go to your dentist, be sure to provide them with your group number.

Additional Resources

- Enrollees and their eligible dependents are required to use a dentist who is a contracted DeltaCare USA provider.

- Most basic services are covered at no cost.

- View either the Basic or Enhanced Evidence of Coverage for information on covered benefits.

Additional Resources

Check out our wellness site

Read articles, watch videos and sign up for our e-newsletter.

The Consolidated Omnibus Budget Reconciliation Act (COBRA) - Dental

The Consolidated Omnibus Budget Reconciliation Act of 1986 (COBRA) and the Omnibus Budget Reconciliation Act of 1989 (OBRA) require employers to continue Medical, Dental, and Vision coverage for all eligible employees and dependents for up to 18, 29 or 36 months following certain events. The purpose of this continuation of coverage is to ensure access to health coverage for employees who would otherwise lose group coverage under specified circumstances called "qualifying events."

Employee Eligibility

An employee covered by a CSU health plan has a right to choose continuation coverage if group health coverage is lost because:

- Of a reduction in work hours; or

- The termination of employment (other than due to gross misconduct).

Spouse or Domestic Partner Eligibility

A spouse or domestic partner of an employee, covered by a CSU health plan, has the right to choose continuation coverage if group health coverage is lost for any of the following reasons:

- The death of the employee;

- Termination of employee's employment or reduction in employee’s work hours;

- Divorce, legal separation, or dissolution of domestic partnership from the employee; or

- Employee becomes entitled to Medicare.

Dependent Child Eligibility

A dependent child of a covered employee has the right to continuation coverage if group health coverage is lost for any of the following reasons:

- The death of the parent (employee);

- The termination of the parent's employment or reduction in the parent's work hours with the CSU;

- The parents' divorce, legal separation, or dissolution of domestic partnership;

- The parent (employee) becomes entitled to Medicare; or

- The dependent ceases to be a "dependent child" under the CSU health plan.

If an employee does not choose continuation coverage, the employee's coverage will end. However, the employee's spouse or domestic partner and/or eligible dependents may elect continuation coverage, independent of the employee's rejection.

COBRA coverage is effective from the date of the qualifying event. The CSU must notify eligible employees of their right to choose continuation coverage within fourteen (14) days of the qualifying event. An employee’s COBRA rights will be forfeited if the CSU does not receive notification of the employee’s wish to continue coverage within sixty (60) days of the qualifying event or date of the notification.

Following the sixty (60) day election period, an employee or eligible dependents have forty-five (45) days from the date of enrollment to pay for the continued coverage. The first payment will include the cost of coverage beginning with the first date coverage would have otherwise ended. After the initial payment, the required monthly premium is due before each month of coverage. Coverage will be cancelled if payment is not received within the thirty day grace period following each payment due date.

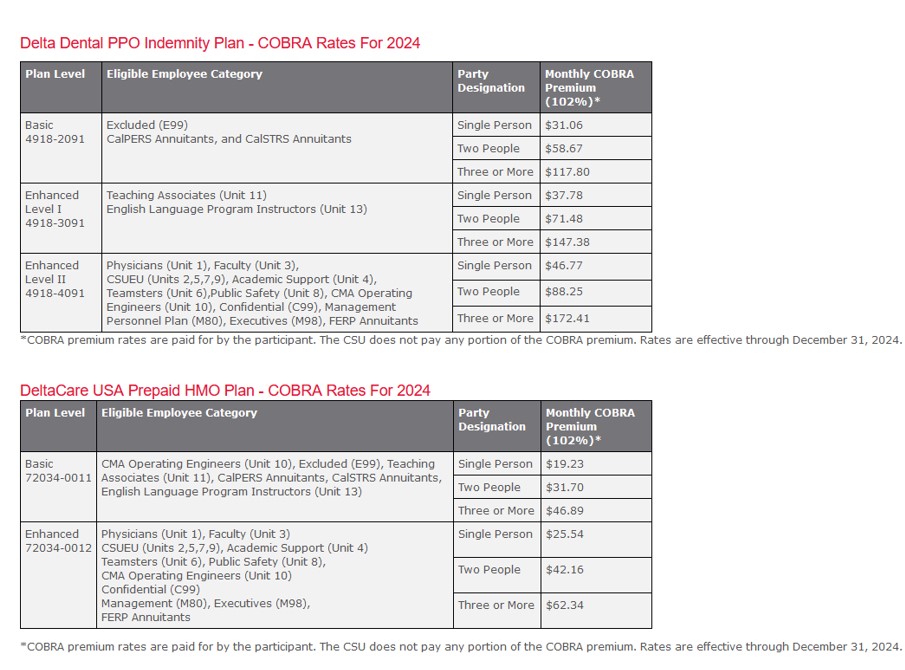

*COBRA premium rates are paid for by the participant. The CSU does not pay any portion of the COBRA premium. Rates are effective through December 31, 2024

Dental

Delta Dental Wolfpack Insurance Services:

Phone: (800) 296-0192

Web site : www.DentalandVisionIns.com