Cal Employee Connect (CEC) - Employee Services: Withholdings Change

We are happy to announce that Cal Employee Connect (CEC) Employee Services feature has expanded to include a Withholdings Change feature. The Withholdings Change feature has been created as an additional self-serve option. If you already have current Withholdings on file, you do not need to submit a new request through CEC.

If you have not registered for CEC, additional information on how to join can be found on the HR/Payroll Cal Employee Connect webpage.

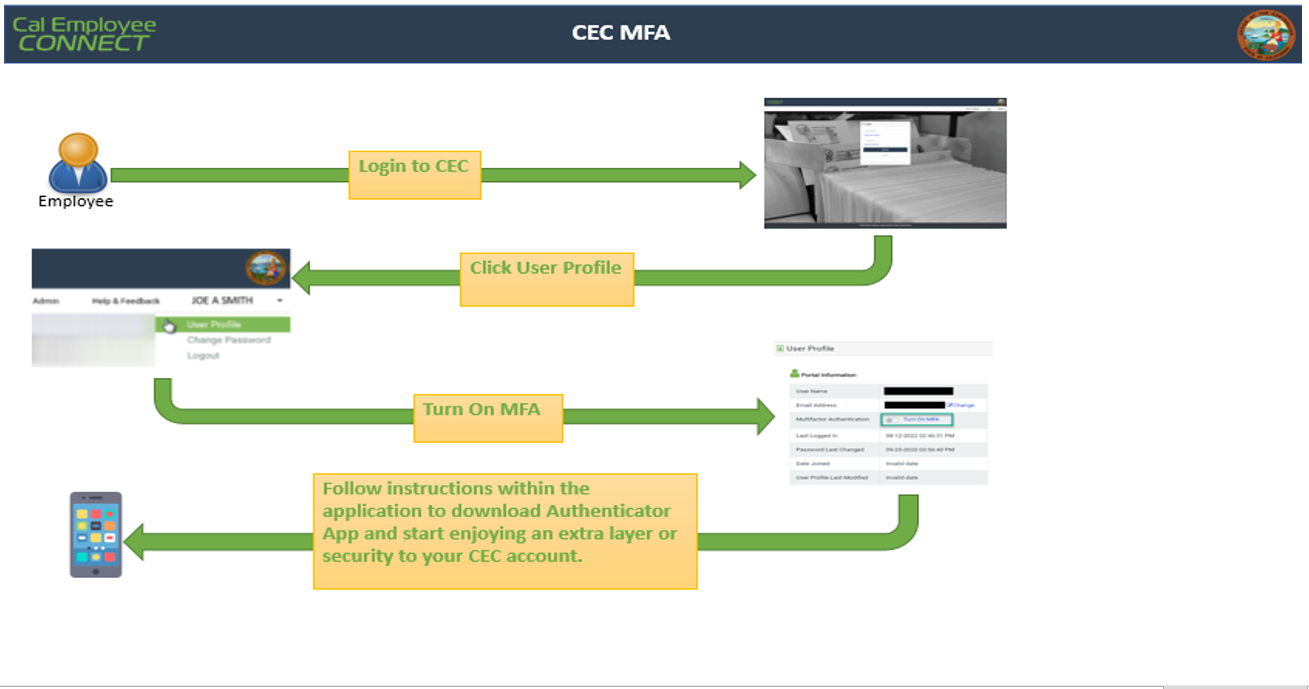

The first step to start using this feature is to enable Multifactor Authentication (MFA).

If MFA is not already enabled, select User Profile, Click Turn-On MFA, and follow instructions within the application to download an authenticator App to your phone and enjoy an extra layer of security to your CEC account.

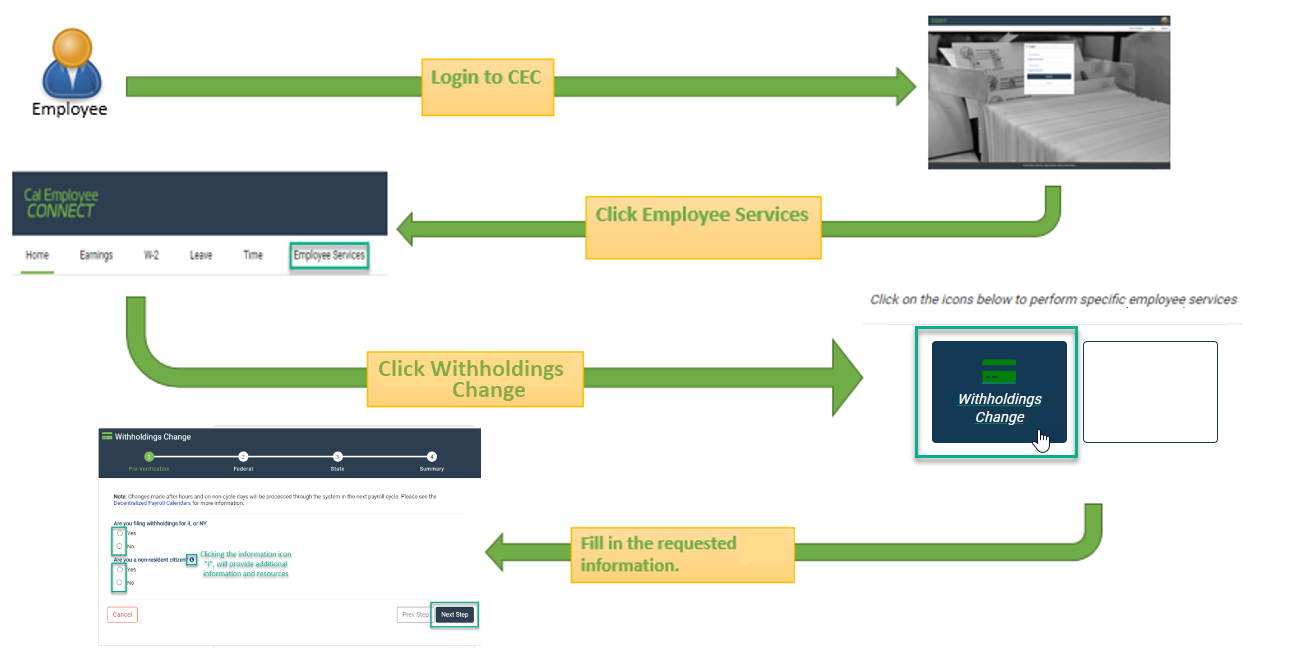

The next step is to submit your Withholdings Change:

Select Employee Services from the top navigation bar and follow instructions within the application.

Note:

- CEC processes Withholdings change requests by close of business Monday through Friday; please allow 24 hours for submitted changes to reflect in your CEC account. If the change is submitted Friday evening through Sunday, the changes will be process the following Monday and changes may reflect in your CEC account as early as Tuesday morning.

- The CEC Team is a technical team and unable to advise on withholdings change. If you have any questions regarding your Withholdings change, please refer to the IRS website.

Link: Cal Employee Connect (CEC) Withholdings Instructions

For technical questions or technical assistance with the Withholdings Change feature, please contact the CEC team at Help & Feedback.

Need Help?